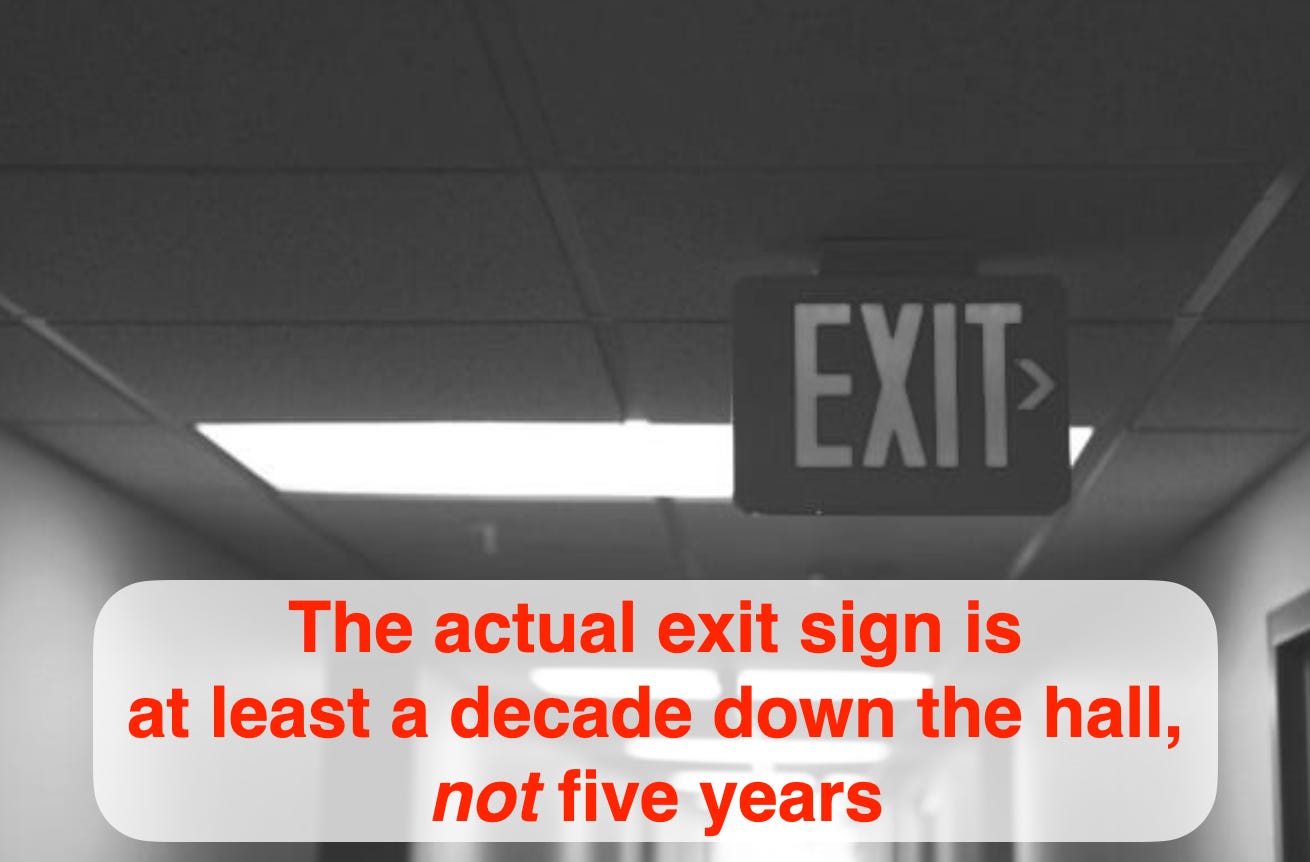

The Myth of the 5-Year Exit

The median exit takes longer than a decade

With the forthcoming acquisition of BeatBox by AB InBev for $700M, remember that company is 13 years old. 💥 📻

Starting a company and achieving an exit in five years is possible, just like it’s possible to win the lottery twice. 🎰

It’s an outlier, yet for many founders I speak with it’s an expectation. 1

The reality is longer and harder:

The median time for a $1B+ SaaS exit is 10 years.2 📈

Companies now stay private for an average of 13-14 years before an IPO.3 🏦

In the drinks space, it’s no different:

🍷 Massican ~14 years before Gallo acquired in 2023

🥤 Poppi ~10 yrs before PepsiCo acquired in 2025

🔋 Alani Nu ~7 yrs before Celsius Holdings acquired in 2025

🍵 Health-Ade Kombucha ~13 yrs before Generous Brands acquired in 2025

🥃 Germain-Robin ~35 years before Gallo acquired in 2017

All took many years to scale and exit. 🗓️

This is the norm.

Compounding growth works best over a long time horizon.

One must invest both their time and money with a decade(s)-long view. 🕰️

They’re anchored to outliers like Casamigos (~4 years from launch to acquisition) and Whiny Baby (~5 years from launch to acquisition).

“Startups are staying private longer thanks to alternative capital” by Robert Frank. Frank cites recent research from Renaissance Capital. Looking at a slightly different set of parameters, David George of Andreessen Horowitz lands at 14 years in his report, “Private Markets Are The New High-Growth Public Markets.” Is it not curious that both these gentlemen have two first names?